Beneath the surface of high-profile investment channels lies a trove of publicly traded companies that have quietly delivered astronomical returns. These market leaders, some once obscure entities, have not only surpassed the coveted 100X return but have also reshaped industries with their innovative products and strategic growth. We explore these high-flying entities that have transformed modest investments into fortunes, spotlighting their financial milestones, market strategies, and the investment wisdom they embody.

💰It’s not only through venture capital or crypto investment that you can make 100X returns. There are several companies where, if you had invested

💲10k 15 years ago, you would now have at least 💲1 million .

🤫Most of these companies were unknown to me. XPEL, the top performer on this list with a staggering 595X return in 15 years, is a company specializing in paint and window protection film for cars, homes, and offices.

🚗It’s a relatively small enterprise that generated $370M in revenue, $73M in EBITDA, and $49M in net profit over the last 12 months, boasting a market cap of $1.5 billion.

But, to my surprise, a few companies on the list are ones I have analyzed and written about recently.

🤖 NVIDIA, the sixth most valuable company globally (with a 1.2 trillion market cap), is renowned for its graphics processing units (GPUs), now pivotal in powering the artificial intelligence (AI) revolution 🌐. If you had bought $10k of NVIDIA stock 15 years ago (and held onto it), you would now have over $2.5 million. Back in 2008, NVIDIA was a $4B revenue company.

Let’s look at some current data (Trailing 12 months) for NVIDIA:

🔸$45 billion in revenue

🔸70% gross margin

🔸49% EBITDA margin

🔸$19B net profit (42% margin)

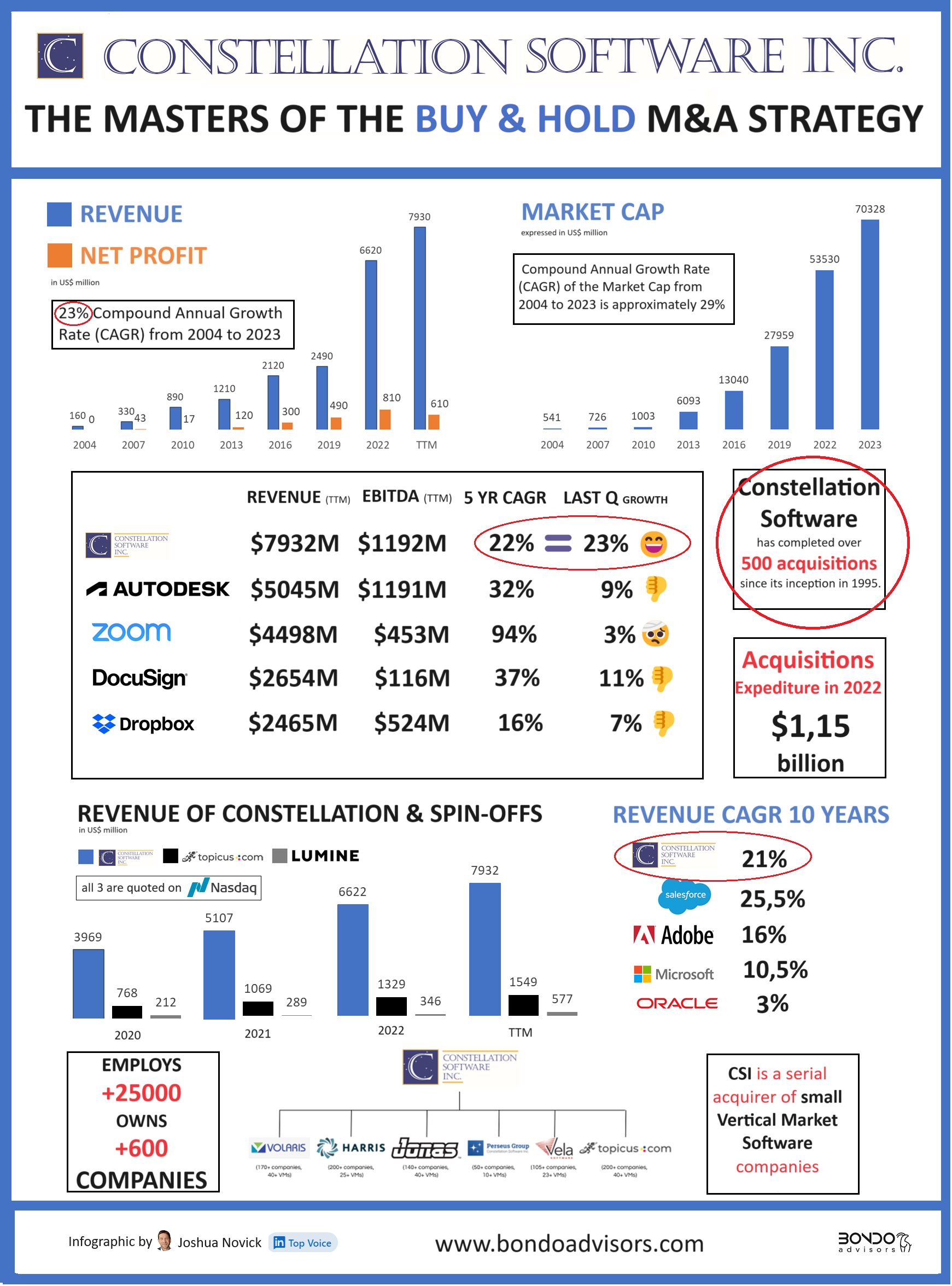

🌌Constellation Software Inc., another favorite of mine (I just posted about it 10 days ago), has returned 171X in the past 15 years! Constellation is a voracious acquirer, having acquired over 500 small software companies. Fifteen years ago, in 2008, it was generating $330 million in revenue.

Some numbers on Constellation, the software roll-up king:

🔸$52 billion market cap (#339 in the worldwide ranking)

🔸$8B revenue and 1.2B EBITDA TTM

🔸23% Revenue CAGR for the last 20 years

Interestingly, Vitec Software Group, essentially the Swedish equivalent of Constellation, sharing the same acquisition strategy, is also on the list with a similar return: 166X in 15 years. This underscores that the «buy, grow and hold forever, small vertical software companies» strategy is a viable long-term business model 👍.

🌱Vitec is much smaller, with a $2B market cap, $230 million in revenue, and $85M in EBITDA over the past 12 months.

📺I ‘m extremely excited to see Netflix on the list 🎥. It’s incredible how this company evolved from selling CDs online to becoming the leader in streaming content, ranking as the 48th most valuable company with a $215B market cap.

Before its foray into streaming in 2007, Netflix was generating under $1B in revenue. Today, its revenue stands at $32B with $4.5B in net profit.

The journey through the remarkable financial achievements of these companies illuminates a path of strategic growth and innovation that has rewarded investors with returns once thought exclusive to the most speculative investments. From the protective film expertise of XPEL to NVIDIA’s GPU dominance fueling the AI revolution, and from Constellation Software’s aggressive acquisition strategy to Netflix’s streaming empire, these companies exemplify the potential of long-term value creation in diverse sectors. Their stories are a testament to the power of patient capital and the importance of recognizing underlying value in a market that’s often swayed by short-term trends. For those who look beyond the surface, the investment landscape is rich with opportunities for extraordinary growth and returns.